- The Indian food and beverage sector is now open to 100 percent foreign direct investment with technology and ready-to-eat food production among the country’s greatest needs

- India wants to export USD100 billion in food and beverage, agriculture, and marine products by 2030

- The food processing sector is predicted to have a compound annual growth rate of more than 15 percent during the remainder of the decade

With the Indian food and beverage sector now open to complete foreign investment, many overseas entities will begin exploring available opportunities. The country does have obstacles to market entry that must be overcome but the upside is tremendous. Asian Insiders India Partner, Pawan Bhatnagar, offers valuable insights on the industry and what the future may potentially hold.

A significant shift occurred at the start of 2025 when Indian Minister of Commerce and Industry Piyush Goyal announced the food and beverage industry would allow 100 percent foreign direct investment (FDI). While overseas ownership had been permitted in food processing, the sweeping change could have a far-reaching impact.

The move is seen as critical for India to reach its stated target of having USD100 billion in combined exports from the food and beverage, agriculture, and marine product industries by the end of the decade. In 2024, the country sent out USD50 billion. The race is now on to double this amount in short order.

Exports are only a part of the equation. Growing food consumption domestically is predicted to surpass USD 1.2 trillion in the next two years with urbanisation and changing consumption patterns spurring future growth.

India is currently responsible for almost a quarter of global milk production while it is a leader in fruits, vegetables, eggs, and meat output as well. The country is also the world’s largest producer of spices. Fish production has ramped up significantly over the past decade.

Interestingly, India is the largest producer of millet and has sought to promote its consumption globally. At present, it makes up a small portion of cereal utilisation. Increasing this could prove to be a boon at home and abroad. Several initiatives have been rolled out focusing on all aspects of millet production.

In addition to permitting 100 percent foreign investment, the government has committed to expediting and simplifying the work permit process for overseas individuals seeking to establish food and beverage businesses in India.

Another factor to consider is India’s free trade agreements (FTAs) with UAE, Australia, and ASEAN. This has increased imports of certain processed foods, dairy, and alcoholic beverages. Negotiations with the UK and European Union remain ongoing and could impact the sector further, particularly premium food segments like wine, cheese, and organic products.

The government is seeking to balance trade liberalisation with domestic industry protection measures, such as higher duties on certain sensitive agricultural products and stricter quality controls.

Hunger for food processing

Food processing will be one of the fastest growing industries in India during the next few years. Some predict the sector’s compound annual growth rate to be around the 15 percent mark due to increasing domestic demand and exports.

FDI into the food processing segment was nearly USD6 billion between 2014 and 2023. Over this time, processed food exports rose by more than 150 percent. Notable overseas investors include Hershey’s, Unilever, Pepsi, Kellog’s, Del Monte, Ferrero, Danone, McCann, Nestle, and Kraft. Given the country’s desire to keep building momentum, further foreign investment is needed.

The Ministry of Food Processing Industries has been instrumental in driving growth through initiatives like the Mega Food Park Scheme (MFPS). The programme aims to create modern infrastructure for the food processing sector across the value chain, from farm to market. More than 40 Mega Food Park (MFP) projects have been approved with 24 already operational.

India’s food processing sector is dynamic and rapidly evolving, playing a pivotal role in the country’s economic landscape. Robust government initiatives, significant foreign investment, and advancements in infrastructure and technology set the stage for substantial growth moving forward.

Indian food and beverage opportunities for foreign investment

There are many Indian food and beverage opportunities available for foreign investment at present. Here is a look at a few of the most notable, although those listed here are far from a definitive list.

Technology

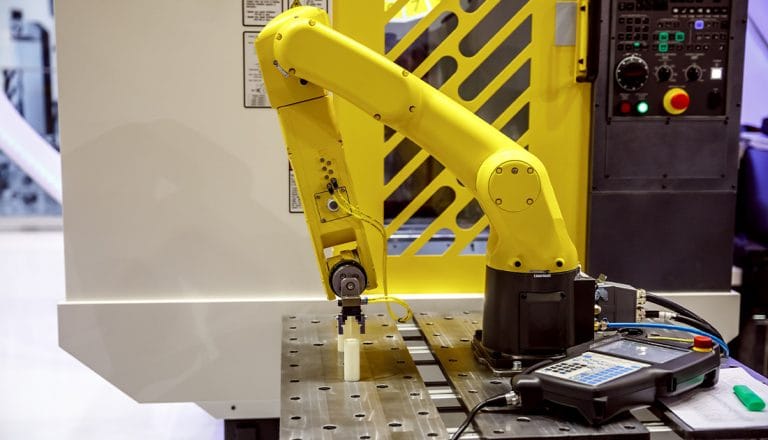

As India seeks to modernise nearly all elements of its food and beverage infrastructure, demand for technology capable of improving efficiency, quality, and food safety is rising. With a desire to scale up exports, the country will also need tools capable of ensuring what is produced meets global standards.

Automation across the value chain is crucial to scaling up food production. Similarly, artificial intelligence tools capable of improving production planning and quality control are increasingly in demand.

Improving infrastructure is another priority. This includes areas such as cold chain and logistics which need updating for India to reach its long-term food production goals.

Sustainability innovation

Sustainability in food production is an area that India wants to improve upon. This spans a wide range of areas. For instance, existing manufacturers are now seeking environmentally friendly packaging. Similarly, any innovation capable of reducing carbon emissions in the production process and supply chain management that helps eliminate waste is required.

Value-add products

Value-add food products are a high potential area spanning from agriculture to fish and meat. They will help diversify the country’s existing product offerings while creating more attractive exports. Firms boasting experience in this area should consider India.

It should also be noted that the country has seen a significant uptick in demand for food providing health benefits. The shifting consumer trend toward nutritious value-added products has created a range of new investment opportunities.

Ready to eat

As income has increased and the country’s middle-class population expands, demand for ready-to-eat products has grown. The market was valued at nearly USD900 million in 2024 with projections showing this figure could rise to more than USD2 billion by 2030.

Several large multinational companies have already entered the ready-to-eat food space in recent years, but there is still room for competition. That is because there is now a growing preference for fast and easy meal options. Demand here should keep rising as local lifestyles continue to evolve.

Final thoughts

Market entry in the country is not always easy, regardless of the sector. While the Indian food and beverage sector permits 100 percent foreign investment and is courting overseas companies, hurdles do remain.

The downside should not deter overseas companies from considering India. In fact, the potential here far outweighs the negatives. Domestic food consumption is predicted to move past USD1 trillion in the next few years. Segments such as food processing are expected to grow by more than 15 percent annually.

Foreign businesses willing to navigate potential obstacles will be able to tap into this staggering growth. Many opportunities are available, and India is eager to welcome overseas firms with the capabilities to boost existing food production.

Finally, there are alternatives to solo operations in India. Collaborations and partnerships are another possibility worth considering, especially for those entities focused on technology or sustainability.

The key to finding the best possible market entry strategy is to work with a local consultant who knows India. A specialist like Asian Insiders can review all your options, introduce you to local connections, and place you on the path to success.

Want to know more about food and beverage opportunities in India? Please contact Jari Hietala, Managing Partner: jari.hietala(at)asianinsiders.com or Pawan Bhatnagar, India Partner: pawan.bhatnagar(at)asianinsiders.com